Umbrella companies

Contents |

[edit] Overview

Umbrella companies are commonly used to employ contractors in the UK, sometimes via recruitment agencies.

Effectively the contractor becomes an employee of the umbrella company and is assigned to work for construction clients. The umbrella company takes on the administrative burden of payrolls, taxation, timesheets, insurance, invoicing, and so on. Where they are used, the recruitment agencies source the appropriate skills required by the construction client.

The use of umbrella companies can:

- Give clients greater flexibility in the contractors that it uses.

- Reduce the potential liabilities and responsibilities of recruitment agencies.

- Reduce the administrative burden for contractors.

- Offer potential benefits in the expenses that contractors can claim (such as travel and accommodation), although these expenses are still subject to HMRC rules.

Umbrella companies can be seen as a means for helping contractors comply with intermediaries legislation (IR35), introduced in 2000, which restricts the ability of contractors to claim that they are self-employed (and so reduce their PAYE liabilities) when they are effectively employees. See Intermediaries legislation for more information.

The use of umbrella companies has increased following the introduction of legislation in April 2014 that treats payroll companies as employers, requiring that they subject workers to tax and employee National Insurance Contributions (NICs) deductions at source and introducing a new liability to pay employer NICs. This change was introduced as the government believed that ‘employment intermediaries’, or ‘payroll companies’ were being used to enable workers to falsely claim that they were self-employed sub-contractors when in fact they were permanent, full-time employees. This allowed them to reduce their employment taxes and obligations. See payroll companies for more information.

The move to use umbrella companies has been criticised as employees effectively pay both employee and employer NICs, may not be paid during holidays and may be paid largely through expenses, the eligibility of which is subject to scrutiny by HMRC.

[edit] Updates

[edit] 2015

In the 2015 Budget, Chancellor George Osborne announced '...we will stop employment intermediaries exploiting the tax system to reduce their own costs by clamping down on the agencies and umbrella companies who abuse tax reliefs on travel and subsistence – while we protect those genuinely self-employed' (ref. Chancellor George Osborne's Budget 2015 speech 18 March 2015).

From 6 April 2015, businesses providing two or more workers without operating PAYE must report their details, details of the position and of payments to HMRC.

[edit] 2016

In September 2016, it was reported that the Union of Construction, Allied Trades and Technicians (UCATT) was encouraging members to down tools to protest about umbrella companies, saying “...workers are sick and tired of paying umbrella companies and this campaign will show them that by undertaking a bit of collective action they can do something about it.”

[edit] 2018

In September 2018, the union Unite called for the government to crack down on abuses relating to umbrella companies and the apprenticeship levy which was introduced in 2017. The levy applies to any company with a payroll of more than £3 million. Those companies must pay 0.5% of payroll costs in tax to help fund apprenticeships.

According to Unite, some self-employed construction workers are having the levy deducted from their pay by employment agencies and umbrella companies.

Unite assistant general secretary Gail Cartmail said: “The most unscrupulous umbrella companies and agencies are deliberately undermining the apprentice levy by forcing workers to pay something which is supposed to be their responsibility.

“The government must immediately look at this scam and introduce measures to prevent workers from being charged in this way. If the government fails to act, support and confidence in the apprenticeship levy will be further undermined.”

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Tackle the decline in Welsh electrical apprenticeships

ECA calls on political parties 100 days to the Senedd elections.

Resident engagement as the key to successful retrofits

Retrofit is about people, not just buildings, from early starts to beyond handover.

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

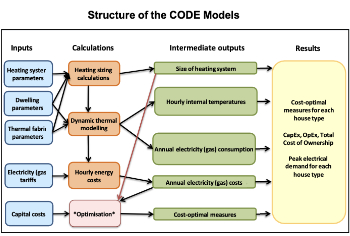

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.